- Get Maturity Benefit

- In-built Premium Waiver

- Stay Protected with Life Cover

A boy-in-squares bagging escapades of switching streets in groove & sensing musical airy-notes from 6 1". Under wayed nyctophile sketching the walls of life from the panorama of anime.

Reviewed By:

Sharan Gurve has spent over 9 years in the insurance and finance industries to gather end-to-end knowledge in health and term insurance. His in-house skill development programs and interactive workshops have worked wonders in our B2C domain.

Updated on Jul 08, 2025 4 min read

Benefits of a Child Education Plan

Financial planning is always advisable, and as a parent, you must first take care of your child’s future well-being and success. Nowadays, one of the best financial choices a parent can make is investing money into their child’s education. It’s high time to worry about your child’s studies because the cost of education in India is absurdly high.

Keeping this in mind, insurance providers came up with a child education plan that combines investments, savings, and insurance. In this plan, parents can save or invest money for their children’s education and get fair returns once a child reaches the age of pursuing higher education.

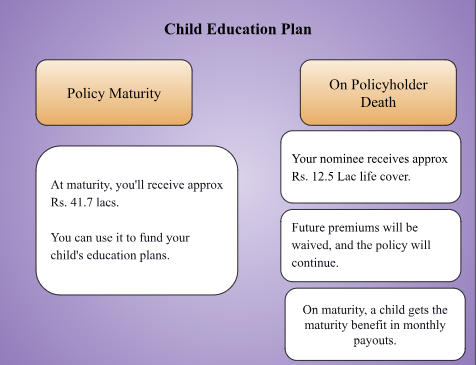

Upon the policyholder’s demise during the policy term, the future premiums will be waived off, and the policy will continue till maturity. Keep reading to learn more about the benefits of a child education plan and why you need one.

Top 6 Benefits of a Child Education Plan

Cover Your Child’s Future Education

By investing in a child education plan, you can save for your kid’s higher education and tackle education inflation. The returns from the child education plan help you stay prepared for your child’s education expenses, such as tuition fees, books, travel, and other educational expenses.Secure a Child’s Future with Life Cover

One of the best aspects of a child education plan is that it provides the dual benefit of saving and protection. Upon the insured parent’s unfortunate death during the policy term, the 100% life cover amount shall be payable to the nominee. Most child plans come with an in-built premium waiver feature. It waives future premiums on the death of a parent, and the policy continues until maturity. The maturity amount shall be payable to the child at the end of the policy term.Benefits upon Maturity to Cover College Costs

In India, education costs are absurdly high and have been consistently increasing. They will be even more expensive when your child is ready for higher education. Therefore, it is no less than a necessity to invest in a child-saving plan. Once the policy matures, the lump sum maturity amount shall be payable to you. It guarantees you have a substantial corpus prepared for your child’s college entrance.Get Triple Benefit of Child Plan

Most child plans come with a triple benefit, which allows you to secure your child’s future even in your absence.- Upon your unfortunate demise, the life cover amount shall be payable to your family to meet immediate expenses.

- The policy will continue until maturity, and the insurer will cover the remaining premiums.

- The maturity benefit shall be payable to your child in annual income to meet the regular expense.

Flexibility to Make Partial Withdrawal

Most child plans offer partial withdrawal flexibility, which allows you to access a portion of your accumulated fund value in case of any financial emergency. It helps you meet the child’s education expenses at all milestones, such as admission fees, tuition expenses, or educational trips. With partial withdrawal, you can access funds for small costs without compromising the overall savings for higher education. Please note that the plan has a mandatory lock-in period of five years.

Tax Benefits on Child Education Plan

Sections of the Income Tax Act, 1961 | Tax Benefits under Child Education Plan |

Section 80C | In this section, premiums you pay toward your policy are eligible for tax benefits. You can get a tax exemption of up to ₹1.5 lakhs. |

Section 10(10D) | Get Tax-free maturity from your child plan with an annual premium of up to 2.5 lacs. |

How Does a Child Education Plan Work?

Let’s understand this with the help of an example:

- Mr Akash, a 40-year-old professional, invests in a child plan for his 5-year-old son.

- He chooses a 5-year premium payment term, a 15-year policy term, and Rs. 10,000 monthly premiums.

Conclusion

It is important to start saving for your child’s education in advance because India’s education costs are absurdly high. With a child insurance plan, you can save enough money for your child’s future academic interests. Building a corpus for your children’s higher education offers a life cover to compensate your family for their loss. For further assistance, you can contact our insurance experts and get free advice in no time.

Top Benefits of Child Education Plan: FAQs

1. What is a child education plan?

A child education plan combines investments, savings, and insurance. It helps you build a corpus for your children’s higher education and offers a life cover to compensate your family for their loss.

2. What will happen to the child’s education plan after the policyholder’s demise?

Upon the policyholder’s demise during the policy term, future premiums will be waived, and the policy will continue until maturity.

3. Can I add a rider to the child education plan?

Yes, you can choose add-ons or rider benefits while purchasing a child education plan. However, the availability and types of riders you can add depend on the insurance provider and the specific plan.

4. When can money be withdrawn from a child’s plan?

Under the child education plan, you can withdraw your accumulated funds after the lock-in period of five years.

5. Can a child plan be purchased for a 10-year-old?

Yes, you can purchase a child education plan for a 10-year-old. It guarantees you have a substantial corpus prepared for your child’s college entrance.

Life Insurance Companies

Share your Valuable Feedback

4.3

Rated by 8 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Sahil Singh Kathait

A boy-in-squares bagging escapades of switching streets in groove & sensing musical airy-notes from 6 1". Under wayed nyctophile sketching the walls of life from the panorama of anime.

Do you have any thoughts you’d like to share?